Asset allocation formula

Where is the current value of a call is the current value of a put is the discount factor is the forward price of the asset and is the strike price. Heres what you need to know to invest 401k money.

Asset Management Lecture 15 Outline For Today Performance Attribution Ppt Download

Selecting an asset allocation in your 401k is one of the first steps of retirement planning.

. Whereas in 2019 name brand baby formula cost American parents anywhere from 9 cents per ounce to 32 cents per ounce by the first half of 2022 the price of such products had soared to a range of 54 cents per ounce to 115 per ounce or higher if youre not shopping at a discount. Combine the benefits of one of the most powerful eCommerce platforms Magento and eCommerce Experts of Emipro to maximize the growth and efficiency of your online business. Variance is a measurement of the spread between numbers in a data set.

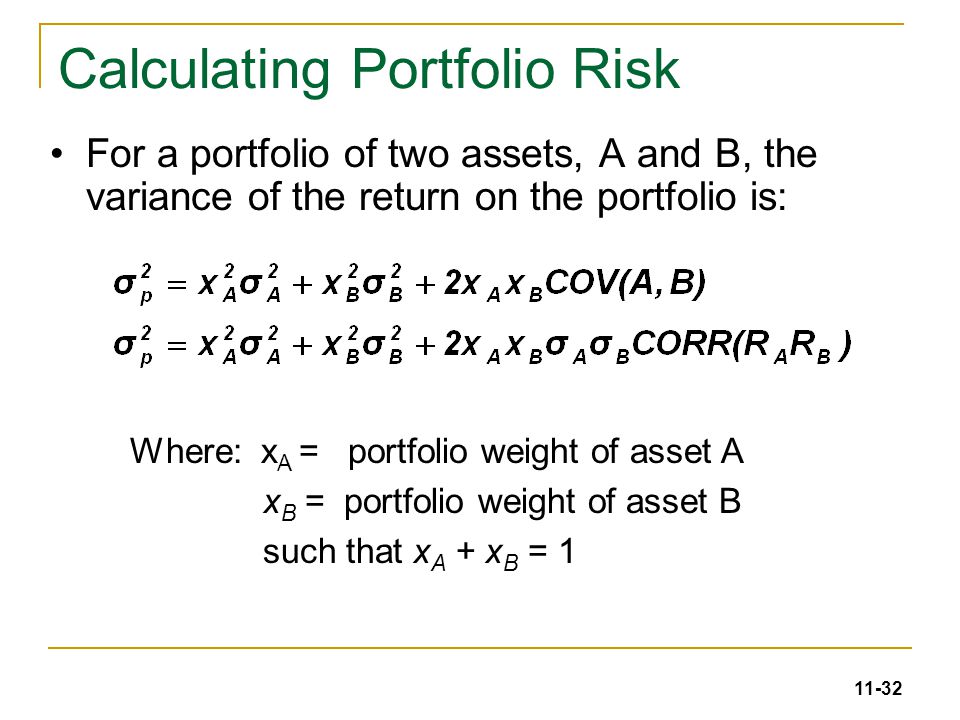

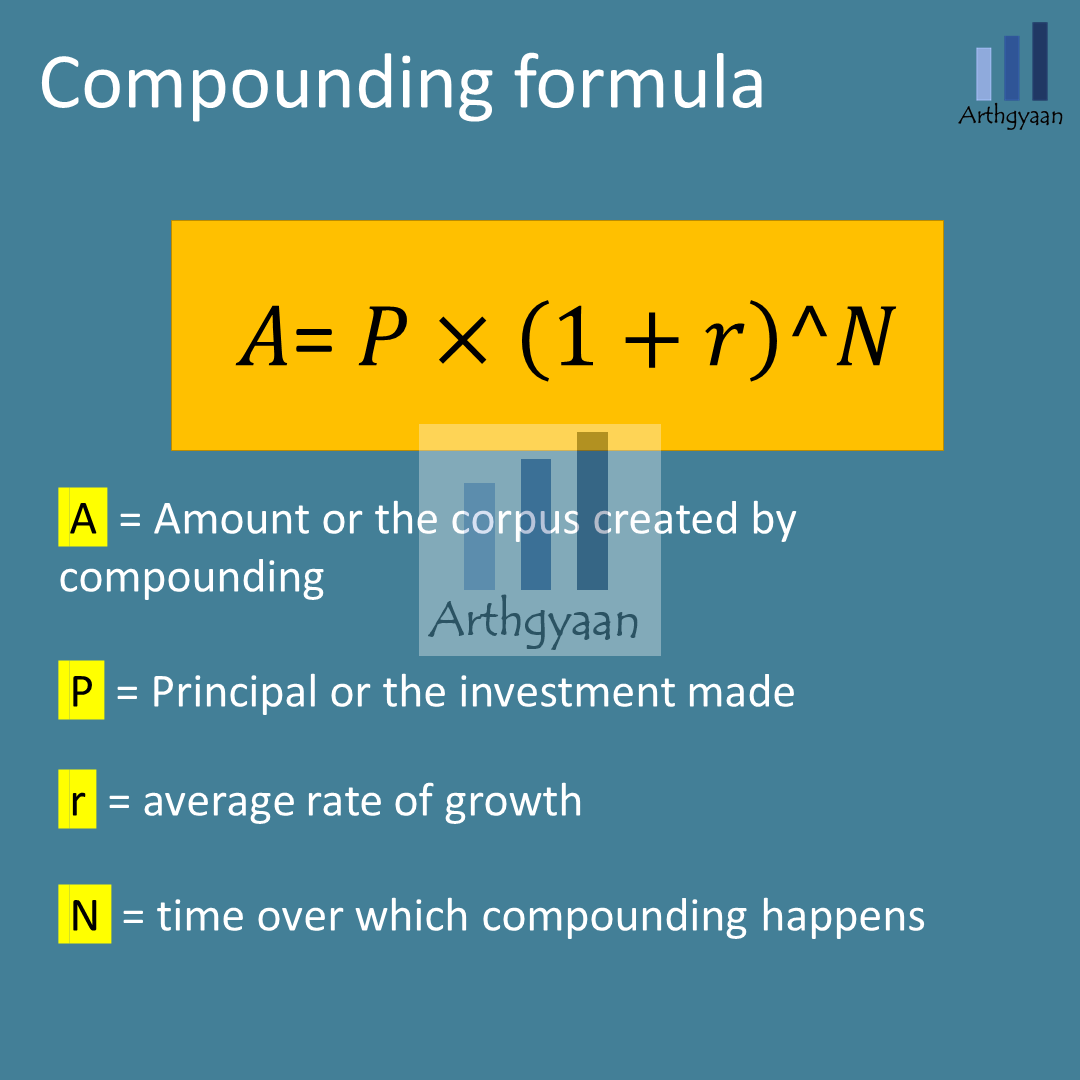

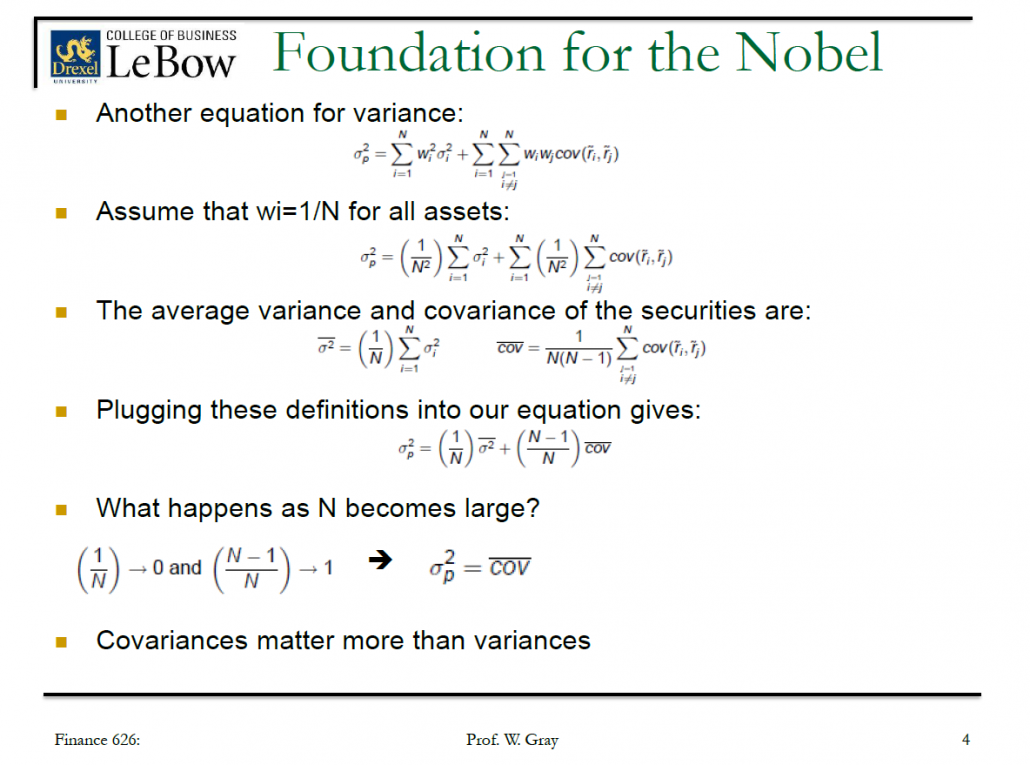

Modern portfolio theory MPT or mean-variance analysis is a mathematical framework for assembling a portfolio of assets such that the expected return is maximized for a given level of risk. Under a strategic asset allocation approach even if stocks are performing well at present you should sell the excess 10 in stocks in order to bring your stock allocation back down to the target of 60. 8000 as the depreciation expense every year over the next ten years as shown in the.

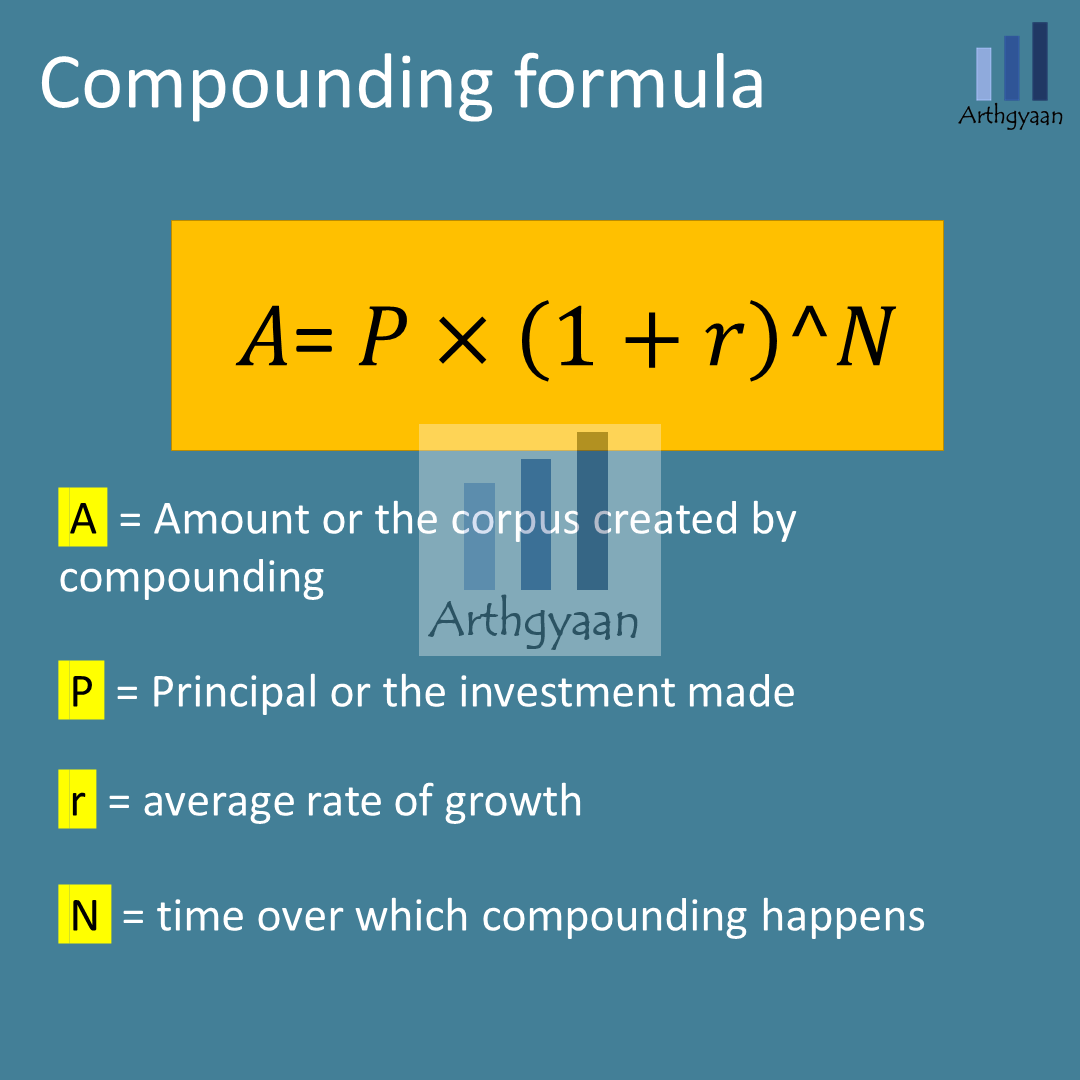

For a 70-year-old retiree for example it yields an asset allocation of 4060 stocksbonds. The asset allocation that works best for you at any given point in your life will depend largely on. It is very easy and simple.

ECommerce Solutions to empower your online business. It is a formalization and extension of diversification in investing the idea that owning different kinds of financial assets is less risky than owning only one type. Designingmarketing a toy flipping a house or planning a trip.

The process of determining which mix of assets to hold in your portfolio is a very personal one. Recently filed their 13F report for the second quarter of 2022 which ended on 2022-06-30. The variance measures how far each number in the set is from the mean.

100000 and the useful life of the machinery are 10 years and the residual value of the machinery is Rs. What are large cap stocks in which Large Cap Funds invests. Opportunity Cost Formula in Excel With Excel Template Here we will do the same example of the Opportunity Cost formula in Excel.

Thus the company can take Rs. For instance say you started with an asset allocation that targets 60 stock and 40 bonds but 70 of your portfolio consists of stocks. Youll analyze the theoretical frameworks of the modern portfolio theory MPT and the capital asset pricing model CAPM while exploring how to apply multi-factor asset pricing.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. 12 in what is believed to be the largest private-sector nurses strike in US. How to Calculate Your Debt-to-Income Ratio.

Asset Allocation for Stock 100 A. To calculate your debt-to-income ratio add up your recurring monthly debt obligations such as your minimum credit card payments student loan payments car payments housing payments rent or mortgage child support alimony and personal loan payments. Wherein A is the age of the individual.

The 9010 rule in investing is a comment made by Warren Buffett regarding asset allocation. Note that the spot price is given by spot price is present value forward price is future value discount factor relates these. Students manage money in group projects requiring allocation of limited finances and resources ie.

Has skyrocketed and thats if you can find any. Manages resources Students manage resources in projects requiring allocation of limited finances resources materials and personnel. Get 247 customer support help when you place a homework help service order with us.

SEBI classifies the top 100 stocks by market capitalization as large cap. Annual Depreciation expense 100000-20000 10 Rs. Make sure you are on track to meet your investing goals.

Profitability from First Order is calculated using Opportunity Cost Formula. 15000 Minnesota nurses to strike as they demand better conditions Nurses plan to stop working Sept. Portfolio managers are listed as Michael Burry.

The rest of the portion will be either invested in bonds or cash which are less risky when compared to stock. Variance is calculated by taking the differences. Michael Burry and his fund Scion Capital were made famous by the movie The Big Short which documented the history and events leading up to his contrarian but hugely successful bet against the real estate market in 2008.

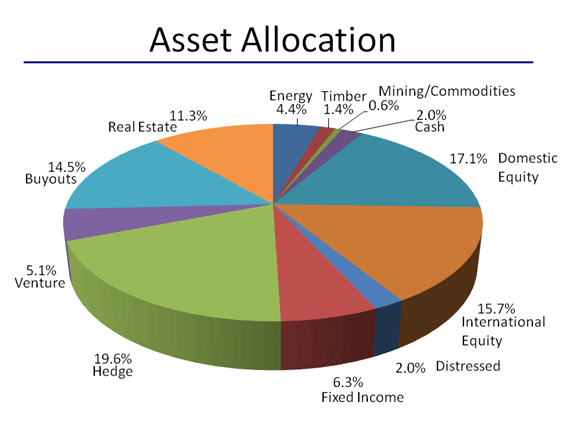

Market cap segment allocation as on 31st Oct 2020 was 86 large cap 11 midcap 1 small cap and 2 held in cash or cash equivalents. Asset allocation is an investment strategy that aims to balance risk and reward by apportioning a portfolios assets according to an individuals goals risk tolerance and investment horizon. The 13F report details which stocks were in a gurus equity portfolio at the end of the quarter though investors should note that these filings are limited in scope containing only a snapshot of long positions in US-listed stocks and American depository.

Example Suppose a manufacturing company purchases machinery for Rs. To find the right asset allocation for you go to our asset allocation calculator. What we want Apple to unveil at WWDC.

Again my preferred formula above number 3 accelerates the shift to bonds after age 40. The cost of baby formula in the US. You can easily calculate the Opportunity Cost using Formula in the template provided.

How much should I save if I want to retire early. Retirees may also desire to simply use stock dividends andor bond interest as income which will influence asset allocation. The rule stipulates investing 90 of ones investment capital towards low-cost stock-based index funds.

The left side corresponds to a portfolio of long a call and short a put while the right side corresponds. More Funds from Mirae Asset Mutual Fund Out of 34 mutual fund schemes offered by this AMC 3 isare ranked 4 10 isare ranked 3 1 isare ranked 1 and 20 schemes are not ranked. Asset Allocation was designed by professors Christopher Geczy and Jules van Binsbergen to equip you with different portfolio strategies and risk management tools.

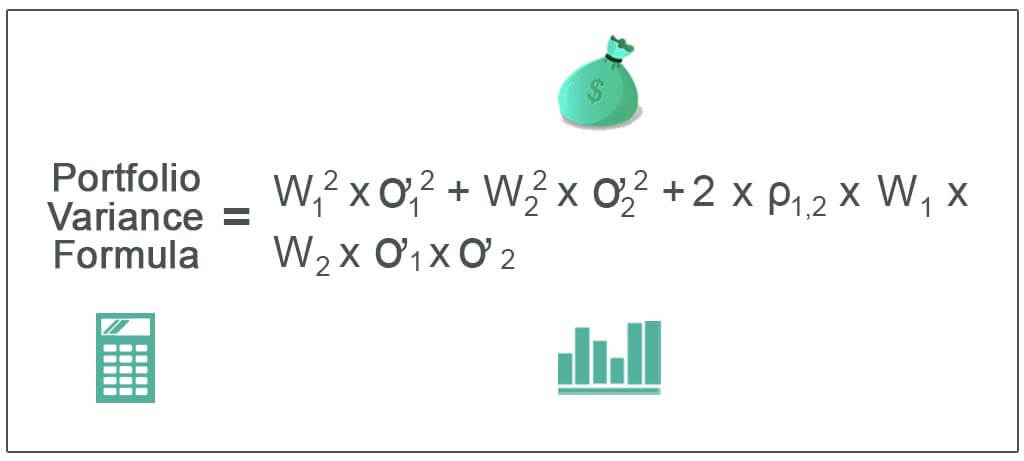

Asset allocation involves dividing an investment portfolio among different asset categories such as stocks bonds and cash. Scion Asset Management LLC has disclosed 1 total holdings in their latest SEC filings. The formula for Calculating Asset Allocation is per below.

BOYAR ASSET MANAGEMENT INC.

Lower Risk By Rethinking Asset Allocation Seeking Alpha

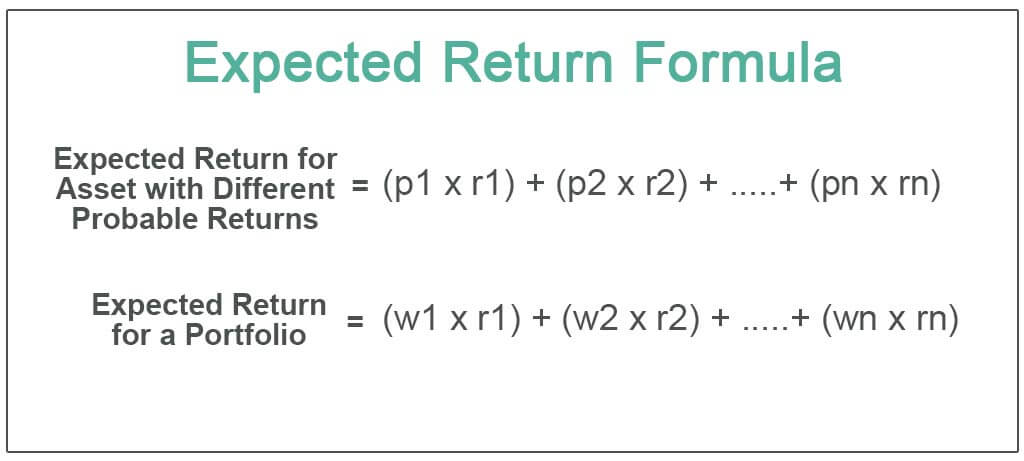

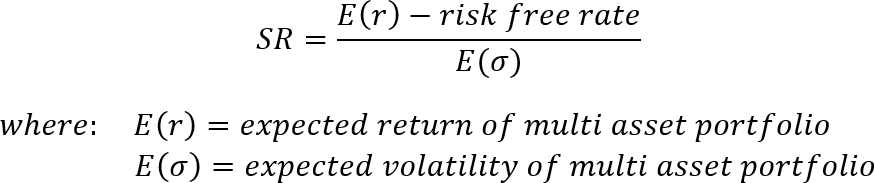

Expected Return Formula Calculate Portfolio Expected Return Example

/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

Chapter 5 Risk And Rates Of Return N

Diversification And Risky Asset Allocation Ppt Video Online Download

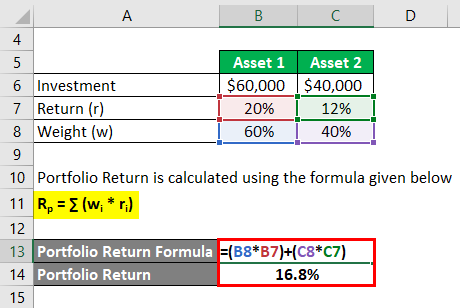

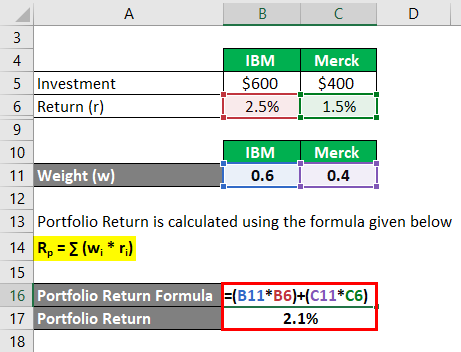

Portfolio Return Formula Calculator Examples With Excel Template

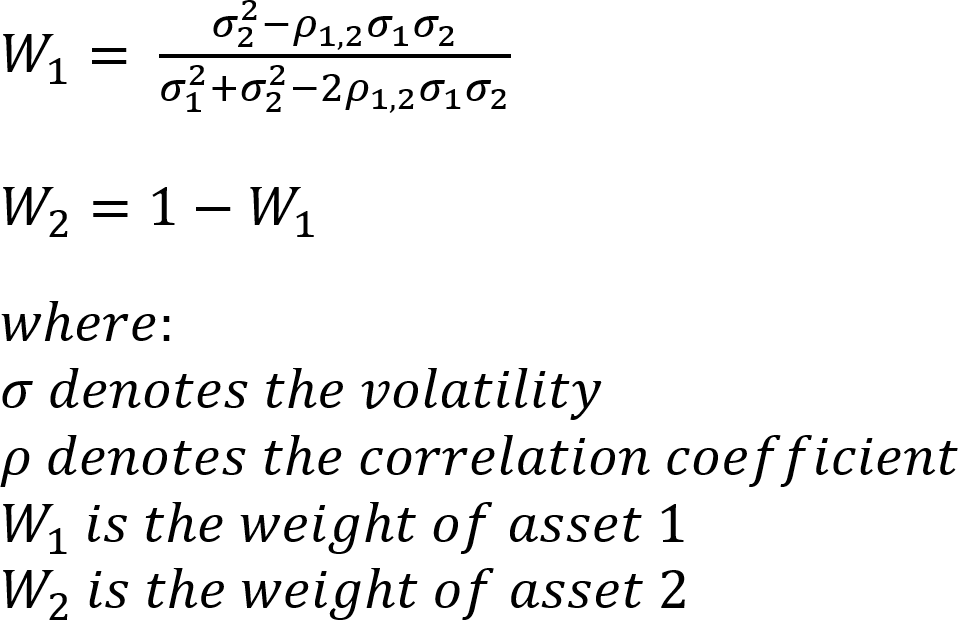

Optimization Formula For Optimal Portfolio Of 2 Assets When No Shorting Allowed Quantitative Finance Stack Exchange

Solactive Diversification The Power Of Bonds

Portfolio Rebalancing During Goal Based Investing Why When And How Arthgyaan

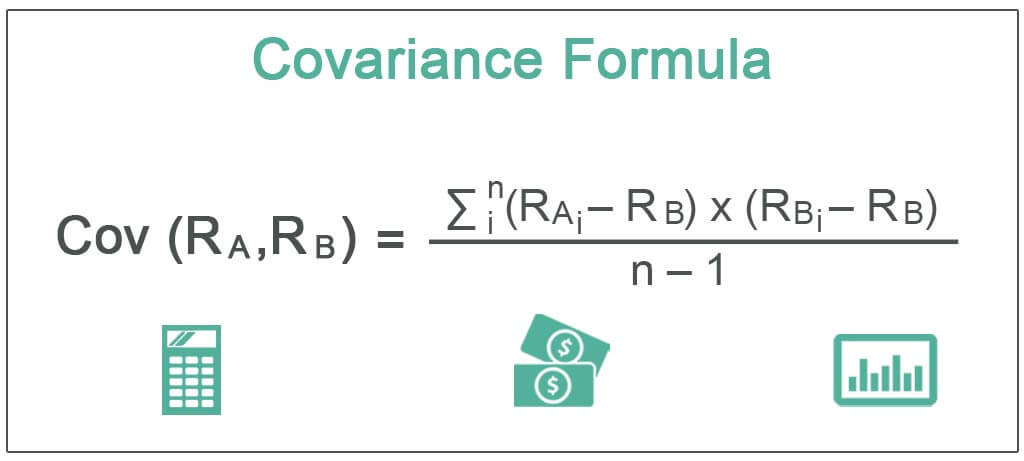

Covariance Meaning Formula How To Calculate

Standard Deviation And Variance Of A Portfolio Finance Train

Portfolio Variance Formula Example How To Calculate Portfolio Variance

Tactical Asset Allocation Beware Of Geeks Bearing Formulas

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

Portfolio Return Formula Calculator Examples With Excel Template

Solactive Diversification The Power Of Bonds

Portfolio Return Formula Calculator Examples With Excel Template